Embarking on your maiden voyage into the realm of digital currencies signifies a plunge into a world brimming with opportunities and complexities alike.

Discovering how to procure these digital assets and where to procure them is akin to navigating through uncharted waters, where each decision holds the potential to shape your journey profoundly.

Unveiling the intricacies of purchasing cryptocurrencies unveils a tapestry woven with myriad platforms, each offering its unique blend of features and quirks.

Unlocking the mysteries of this nascent financial landscape demands not only a keen eye but also a strategic approach, for the choices made today may ripple across your financial horizon for years to come.

Join us as we embark on a voyage of discovery, charting a course through the turbulent seas of cryptocurrency acquisition, uncovering hidden gems and avoiding treacherous pitfalls along the way.

Understanding Cryptocurrency Fundamentals

In grasping the essence of cryptocurrencies, it’s paramount to delve into their foundational principles.

The Concept of Cryptocurrency

Cryptocurrency, in essence, represents a digital or virtual form of currency secured by cryptography, functioning as a medium of exchange.

This digital currency operates on decentralized networks based on blockchain technology, ensuring transparency, security, and immutability.

Key Components of Cryptocurrency

At its core, cryptocurrency comprises various elements essential for its functionality:

- Cryptographic Security: Cryptocurrencies employ cryptographic techniques to secure transactions and control the creation of new units.

- Decentralization: Unlike traditional currencies controlled by central authorities, cryptocurrencies operate on decentralized networks, empowering users with control over their assets.

- Blockchain Technology: Cryptocurrencies leverage blockchain, a distributed ledger technology, to record and verify transactions across a network of computers.

- Digital Wallets: Users store and manage their cryptocurrencies using digital wallets, which consist of public and private keys enabling secure transactions.

- Mining and Consensus Mechanisms: Certain cryptocurrencies utilize mining or alternative consensus mechanisms to validate and authenticate transactions within the network.

By comprehending these fundamental aspects, individuals can navigate the cryptocurrency landscape with a deeper understanding of its underlying principles.

Choosing the Perfect Cryptocurrency Wallet

When venturing into the realm of digital assets, one of the initial steps is selecting a suitable wallet to safeguard your investments. This pivotal decision can significantly impact the security and accessibility of your crypto holdings. Here’s a breakdown to guide you through the process.

Understanding Wallet Types:

Before delving into specifics, it’s crucial to grasp the different types of wallets available. Wallets come in various forms, including hardware, software, mobile, and paper wallets. Each type offers distinct features and levels of security, catering to diverse needs and preferences.

Evaluating Security Measures:

Security stands as a paramount concern in the crypto sphere. Assessing the security features of a wallet is imperative to safeguard your digital assets against potential threats. Look for wallets equipped with robust encryption, two-factor authentication, and backup and recovery options to fortify your defenses against cyberattacks.

Weighing Convenience and Accessibility:

While security is paramount, convenience and accessibility also play pivotal roles in choosing the right wallet. Consider factors such as user-friendliness, compatibility with your preferred cryptocurrencies, and accessibility across multiple devices. Opt for wallets that offer seamless integration with popular exchanges and services for streamlined transactions.

Exploring Custodial vs. Non-Custodial Wallets:

Another critical consideration is whether to opt for a custodial or non-custodial wallet. Custodial wallets, provided by exchanges and third-party services, manage your private keys on your behalf, offering convenience but relinquishing some control. Non-custodial wallets, on the other hand, grant you full control over your private keys, enhancing security but requiring greater responsibility.

Researching Reputation and Reliability:

Before committing to a wallet, conduct thorough research into its reputation and reliability. Explore user reviews, community forums, and independent assessments to gauge the experiences and opinions of other users. Prioritize wallets with a proven track record of security, reliability, and prompt customer support.

Conclusion:

Choosing the perfect cryptocurrency wallet entails careful consideration of various factors, including security, convenience, custody options, and reputation. By conducting diligent research and weighing your priorities, you can select a wallet that aligns with your needs and empowers you to navigate the crypto landscape with confidence.

Exploring Various Cryptocurrency Trading Platforms

When delving into the realm of digital currencies, it’s imperative to choose the right cryptocurrency exchange to suit your needs. These platforms serve as marketplaces where individuals can buy, sell, and trade various cryptocurrencies. Here’s a breakdown of some popular cryptocurrency exchanges:

| Exchange | Key Features |

|---|---|

| Binance | Known for its extensive range of cryptocurrencies available for trading, low fees, and advanced trading features such as margin trading and futures contracts. |

| Coinbase | A user-friendly platform ideal for beginners, offering a simple interface, a variety of cryptocurrencies for purchase, and a secure wallet for storage. |

| Kraken | Offers a wide selection of cryptocurrencies, advanced trading options, and robust security measures, making it a favorite among experienced traders. |

| Bitfinex | Known for its liquidity and advanced trading tools, Bitfinex caters to professional traders and offers features like margin trading and lending. |

| Gemini | Regulated exchange with a focus on security and compliance, making it a trusted choice for both retail and institutional investors. |

When deciding which exchange to use, consider factors such as supported cryptocurrencies, trading fees, security measures, user interface, and customer support. It’s also advisable to research each platform thoroughly and possibly experiment with a few to find the one that best aligns with your trading preferences and goals.

Security Measures: Safeguarding Your Investments

When venturing into the world of digital assets, ensuring the safety of your investments is paramount. Here are some essential security measures to shield your crypto holdings:

1. Utilize Secure Wallets

One of the foundational aspects of safeguarding your cryptocurrencies is to utilize secure wallets. These digital containers store your assets and come in various forms such as hardware wallets, software wallets, and paper wallets. Hardware wallets, like Ledger or Trezor, offer offline storage, providing heightened security against online threats such as hacking.

2. Implement Two-Factor Authentication (2FA)

Enhance the security of your accounts by implementing two-factor authentication (2FA). This additional layer of protection requires users to provide two forms of verification before accessing their accounts, typically a password and a unique code sent to their mobile device or email. Enabling 2FA significantly reduces the risk of unauthorized access, fortifying your crypto holdings against potential breaches.

By integrating these security measures into your crypto investment strategy, you can mitigate risks and safeguard your assets from potential threats.

Exploring Potential Crypto Investments

When delving into the realm of digital currencies, it’s essential to conduct thorough research before making any investment decisions. Here’s a step-by-step guide to help you navigate the process:

Educate Yourself

Before diving into the world of cryptocurrencies, take the time to educate yourself about the fundamental concepts, such as blockchain technology, decentralized finance (DeFi), and the various types of digital assets available.

Identify Your Investment Goals

Define your investment objectives, whether it’s long-term wealth accumulation, portfolio diversification, or short-term gains. Understanding your goals will guide your investment strategy and risk tolerance.

Conduct Market Research

Explore different cryptocurrency projects and tokens to understand their purpose, utility, and potential for growth. Utilize resources like cryptocurrency exchanges, forums, and news websites to stay updated on market trends and developments.

Assess Project Fundamentals

Evaluate the fundamentals of each project by researching factors such as the team behind the project, its technology, community support, adoption rate, and regulatory compliance. Pay close attention to whitepapers and project roadmaps to gauge future potential.

Analyze Technical Indicators

Study technical indicators and price charts to identify entry and exit points for potential investments. Tools like moving averages, relative strength index (RSI), and Fibonacci retracement levels can help you make informed trading decisions.

Consider Risk Management

Implement risk management strategies to protect your investment capital. Diversify your portfolio across different cryptocurrencies, asset classes, and investment strategies to mitigate potential losses.

Stay Informed

Stay updated on market news, regulatory developments, and technological advancements within the cryptocurrency space. Continuous learning and adaptation are crucial for successful long-term investing.

By following these steps and staying diligent in your research, you can make informed decisions when exploring potential cryptocurrency investments.

Strategies for Mitigating Risk in Cryptocurrency Trading

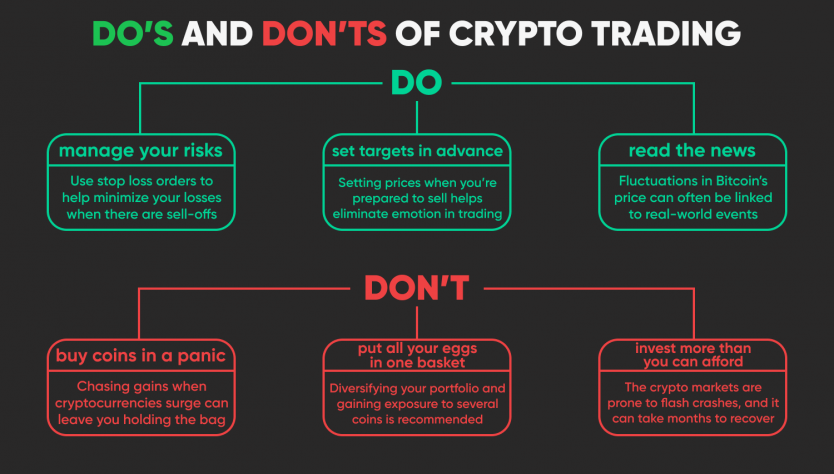

Engaging in cryptocurrency trading can be both exciting and lucrative, but it’s crucial to approach it with a keen awareness of the associated risks. Here are some strategies to help you manage risk effective

Exploring Various Investment Approaches

When diving into the realm of digital assets, it’s crucial to understand the diverse range of investment strategies available. Here, we delve into different avenues you can explore to maximize your cryptocurrency investments.

- Long-term Holding: Opting for a long-term holding strategy involves purchasing cryptocurrencies with the intention of keeping them for an extended period. This approach relies on the belief that the value of the chosen assets will appreciate significantly over time. Investors who adopt this strategy often prioritize fundamental analysis and look for projects with strong potential for growth.

- Day Trading: Day trading involves frequent buying and selling of cryptocurrencies within short timeframes, often within the same day. This strategy relies heavily on technical analysis, market trends, and volatility. Day traders aim to capitalize on short-term price fluctuations to generate profits. However, it requires a deep understanding of market dynamics and risk management strategies.

- Swing Trading: Similar to day trading, swing trading involves buying and selling cryptocurrencies over a slightly longer period, typically ranging from a few days to a few weeks. Swing traders aim to capture price swings or “swings” in the market, profiting from both upward and downward movements. This strategy requires a blend of technical and fundamental analysis to identify favorable entry and exit points.

- Passive Income Strategies: In the crypto space, there are various ways to generate passive income, such as staking, lending, and yield farming. Staking involves holding cryptocurrencies in a designated wallet to support the network and earn rewards. Lending platforms allow users to lend their digital assets to borrowers in exchange for interest payments. Yield farming involves providing liquidity to decentralized finance (DeFi) protocols in exchange for rewards.

- Diversification: Diversification is a risk management strategy that involves spreading investments across different cryptocurrencies, asset classes, or sectors. By diversifying your portfolio, you can mitigate risk and potentially increase returns. It’s essential to strike a balance between established assets like Bitcoin and Ethereum and promising altcoins with growth potential.

Regardless of the strategy you choose, conducting thorough research, staying updated on market developments, and exercising caution are paramount. Remember that the cryptocurrency market is highly volatile and subject to rapid changes, so always invest responsibly and within your means.

Understanding Blockchain Technology

Blockchain technology is a revolutionary system that underpins cryptocurrencies and has far-reaching applications beyond digital currencies. At its core, blockchain is a decentralized ledger that records transactions across a network of computers in a secure, transparent, and immutable manner.

The Basics of Blockchain

At its essence, a blockchain is a chain of blocks, where each block contains a list of transactions. These transactions are bundled together in a block and linked to the previous block using cryptographic principles, forming a continuous chain of blocks – hence the name “blockchain”.

One of the key features of blockchain is its decentralized nature. Unlike traditional centralized systems where a single authority controls the ledger, blockchain operates on a distributed network of computers (nodes), with each node storing a copy of the entire blockchain. This decentralized architecture ensures transparency, security, and resilience against censorship and tampering.

Key Components of Blockchain

There are several key components that make up a blockchain:

- Blocks: Each block contains a batch of transactions, along with a timestamp and a reference to the previous block, creating a chronological chain of transactions.

- Nodes: Nodes are individual computers or devices that participate in the blockchain network. They maintain a copy of the blockchain and validate transactions.

- Consensus Mechanisms: Consensus mechanisms are protocols that enable nodes to agree on the validity of transactions and the order in which they are added to the blockchain. Popular consensus mechanisms include Proof of Work (PoW) and Proof of Stake (PoS).

- Cryptographic Hash Functions: Cryptographic hash functions are used to secure the integrity of blocks and link them together. Each block contains a unique cryptographic hash that is generated based on the block’s contents.

By understanding the fundamental principles of blockchain technology, individuals can gain insights into its potential applications and make informed decisions about participating in the rapidly evolving digital economy.

Engaging in Initial Coin Offerings (ICOs)

Participating in Initial Coin Offerings (ICOs) can be an exciting opportunity for individuals interested in acquiring new cryptocurrencies at their inception. Here’s a breakdown of how to get involved:

- Educate Yourself: Before diving into any ICO, it’s crucial to thoroughly research the project, its whitepaper, team members, and its goals. Understanding the technology and purpose behind the cryptocurrency will help you make informed decisions.

- Identify Legitimate ICOs: Be wary of scams and fraudulent projects. Look for ICOs with transparent documentation, a strong development team, and a clear roadmap for the project’s future.

- Create a Wallet: To participate in an ICO, you’ll need a compatible wallet that supports the specific cryptocurrency being offered. Ensure your wallet is secure and properly set up before proceeding.

- Find the ICO: Research where the ICO is being hosted and how to participate. Often, ICOs are conducted through the project’s website or specific platforms designed for crowdfunding crypto projects.

- Participate in the Token Sale: Once you’ve identified a legitimate ICO and set up your wallet, you can participate in the token sale. This typically involves sending your investment in the form of cryptocurrency (such as Bitcoin or Ethereum) to the ICO’s address in exchange for the project’s tokens.

- Be Mindful of Regulations: ICO regulations vary by country, and some jurisdictions may have restrictions or requirements for participating in token sales. Ensure you’re compliant with relevant laws and regulations in your area.

- Monitor Your Investment: After participating in an ICO, keep track of your investment and stay updated on the project’s progress. Be prepared for volatility in the value of the tokens, as the cryptocurrency market can be highly unpredictable.

By following these steps and staying informed, you can effectively participate in Initial Coin Offerings and potentially contribute to innovative blockchain projects.

Joining Cryptocurrency Communities and Forums

Engaging in the realm of digital assets involves more than just purchasing coins or tokens. It’s about becoming part of a vibrant community where ideas are shared, ins

Staying Informed: Cryptocurrency Updates and Insights

Keeping abreast of the latest developments and trends in the dynamic world of digital assets is paramount for anyone diving into the realm of cryptocurrencies. Here’s how you can stay in the know:

1. Dive into Crypto News Platforms

Explore reputable cryptocurrency news platforms such as CoinDesk, CoinTelegraph, and CryptoSlate. These platforms offer comprehensive coverage of market trends, regulatory updates, and insights from industry experts.

2. Follow Influential Voices in the Crypto Community

Connect with influential figures in the cryptocurrency space on social media platforms like Twitter and LinkedIn. Follow thought leaders, analysts, and industry insiders for valuable insights and real-time updates.

- Engage with discussions on Twitter by following hashtags like #CryptoNews and #BitcoinUpdates.

- Join LinkedIn groups dedicated to cryptocurrency discussions and networking.

By actively participating in these online communities, you can gain valuable knowledge and stay informed about the latest developments.

Remember, the cryptocurrency landscape is ever-evolving, so staying informed is key to making informed decisions about how and where to buy cryptocurrencies.

Q&A:

What are the first steps to get started in the crypto space?

Getting started in the crypto space involves several key steps. Firstly, you need to educate yourself about cryptocurrencies and blockchain technology to understand the basics. Then, choose a reputable cryptocurrency exchange to create an account and purchase your first crypto assets. It’s essential to prioritize security by setting up two-factor authentication and storing your assets in a secure wallet.

Is it too late to start investing in cryptocurrencies?

No, it’s not too late to start investing in cryptocurrencies. While some early adopters have seen significant gains, the crypto market is still relatively young and offers plenty of opportunities for new investors. It’s crucial to conduct thorough research, diversify your investment portfolio, and be prepared for volatility.

How can I protect my investments in the crypto space?

Protecting your investments in the crypto space requires implementing various security measures. Firstly, choose a reputable exchange with robust security features and enable two-factor authentication to secure your account. Additionally, consider using hardware wallets or cold storage solutions to store your assets offline and safeguard them from hacking attempts. Regularly update your software and be cautious of phishing scams and fraudulent schemes.

What are the risks associated with investing in cryptocurrencies?

Investing in cryptocurrencies carries several risks that investors should be aware of. These include market volatility, regulatory uncertainty, security breaches, and the potential for loss of funds due to hacking or technical issues. Additionally, the value of cryptocurrencies can be influenced by factors such as market sentiment, technological developments, and geopolitical events, making it a highly speculative investment.

How can I stay updated with the latest news and developments in the crypto space?

Staying updated with the latest news and developments in the crypto space is essential for making informed investment decisions. You can follow reputable cryptocurrency news websites, subscribe to industry newsletters, and join online communities and forums dedicated to cryptocurrencies. Additionally, following influential figures and organizations on social media platforms like Twitter and LinkedIn can provide valuable insights into market trends and emerging technologies.

What are some key steps for someone completely new to cryptocurrency to get started?

Entering the crypto space as a beginner can seem daunting, but it’s manageable with some basic steps. First, educate yourself about the fundamentals of blockchain technology and how cryptocurrencies work. Then, choose a reputable exchange to buy your first cryptocurrency and set up a secure wallet to store it. Remember to start with small investments and gradually increase as you become more comfortable.

Reviews

undefined

As a female reader who’s diving into the crypto world, this guide is an invaluable compass. It’s daunting stepping into unfamiliar territory, but this article breaks down the complexities into digestible bits. From understanding blockchain basics to navigating exchanges, it’s a roadmap for beginners like me. The emphasis on security is reassuring; knowing how to safeguard my assets is paramount. The glossary is a gem, demystifying jargon that initially seemed alien. Overall, this guide provides the confidence boost needed to take those first steps into the thrilling realm of cryptocurrency.

undefined

As a newbie navigating the crypto landscape, this guide is a gem! It simplifies complex concepts, making them digestible for beginners like me. The step-by-step approach from understanding blockchain to choosing a wallet is invaluable. I appreciate the emphasis on security; it’s reassuring to know how to safeguard my investments. The glossary is a lifesaver, demystifying all the jargon. However, I wish there were more insights on navigating the volatile market and spotting scams. Overall, a fantastic primer for anyone dipping their toes into crypto waters!

undefined

As a beginner delving into the crypto world, this guide provides an invaluable roadmap. The step-by-step breakdown simplifies the complex concepts, making it less daunting for newcomers like me. Explaining the importance of research, risk management, and understanding the technology behind cryptocurrencies is crucial. The emphasis on security measures like using hardware wallets and avoiding phishing scams is reassuring. However, I wish there was more detail on navigating the multitude of available cryptocurrencies and exchanges. Overall, this guide instills confidence and sets the right expectations for someone just starting their crypto journey.

undefined

As a newcomer to the crypto space, this guide is an invaluable resource! The clarity in explaining complex concepts like blockchain and wallets really eases any apprehension I had. I appreciate the emphasis on security measures like using reputable exchanges and safeguarding private keys. The step-by-step approach gives me confidence to take the plunge into this exciting world of digital assets. I’m particularly drawn to the section on understanding market trends and managing risks, crucial aspects often overlooked by beginners. Overall, a well-crafted roadmap for anyone looking to dip their toes into crypto with confidence!

undefined

As a woman new to the crypto space, I found this guide incredibly helpful in navigating the complex world of cryptocurrency. The step-by-step approach made it easy to understand the basics, from setting up a wallet to making your first investment. The emphasis on security precautions was particularly reassuring, as safety is a top priority for me. I appreciate the practical tips on researching projects and managing risks, which have given me more confidence in my decisions. Overall, this guide has demystified crypto for me and empowered me to start my journey with clarity and caution. I’m excited to see where this new venture takes me!

undefined

As a female reader curious about venturing into the crypto space, this guide is an absolute gem! It breaks down complex concepts into easily digestible nuggets of information, making it less intimidating for newcomers like myself. The step-by-step approach offers a clear path to understanding the fundamentals and navigating through the initial hurdles. I appreciate the emphasis on security measures, as it reassures me about safeguarding my investments. Overall, it’s an empowering read that instills confidence in taking the plunge into the exciting world of cryptocurrency.

undefined

As a newcomer to the crypto world, this guide is a lifesaver! The explanations are clear, making complex concepts easy to grasp. I appreciate the emphasis on security measures like using hardware wallets and researching projects thoroughly before investing. The step-by-step approach helps build confidence in navigating exchanges and understanding different cryptocurrencies. I’m excited to start my journey into crypto armed with this knowledge. Thanks for demystifying the process!